summary Table

The summary function provides information on the performance of the Management Procedures with respect to the performance metrics. By default, summary includes the PNOF, P50, AAVY and LTY performance metrics:

summary(MSE)## Calculating Performance Metrics## Performance.Metrics

## 1 Probability of not overfishing (F<FMSY)

## 2 Spawning Biomass relative to SBMSY

## 3 Average Annual Variability in Yield (Years 1-50)

## 4 Average Yield relative to Reference Yield (Years 41-50)

##

## 1 Prob. F < FMSY (Years 1 - 50)

## 2 Prob. SB > 0.5 SBMSY (Years 1 - 50)

## 3 Prob. AAVY < 20% (Years 1-50)

## 4 Prob. Yield > 0.5 Ref. Yield (Years 41-50)

##

##

## Performance Statistics:

## MP PNOF P50 AAVY LTY

## 1 curEref 0.22 0.38 0.33 0.53

## 2 FMSYref 0.50 0.89 0.33 1.00

## 3 FMSYref50 1.00 0.99 0.33 1.00

## 4 FMSYref75 0.89 0.97 0.33 1.00

## 5 NFref 1.00 0.99 0.33 0.00It is straightforward to include other PM functions by adding the names of the PM functions, for example:

summary(MSE, 'P100', 'Yield')## Calculating Performance Metrics## Performance.Metrics

## 1 Spawning Biomass relative to SBMSY

## 2 Yield relative to Reference Yield (Years 1-50)

##

## 1 Prob. SB > SBMSY (Years 1 - 50)

## 2 Mean Relative Yield (Years 1-50)

##

##

## Performance Statistics:

## MP P100 Yield

## 1 curEref 0.13 8.4e-01

## 2 FMSYref 0.30 1.0e+00

## 3 FMSYref50 0.87 8.6e-01

## 4 FMSYref75 0.72 1.0e+00

## 5 NFref 0.95 4.8e-15or all available PM functions:

summary(MSE, avail('PM'))## Searching for objects of class PM in package: MSEtool## Searching for objects of class PM in package: SAMtool## Searching for objects of class PM in package: DLMtool## Calculating Performance Metrics## Performance.Metrics

## 1 Average Annual Variability in Effort (Years 1-50)

## 2 Average Annual Variability in Yield (Years 1-50)

## 3 Average Yield relative to Reference Yield (Years 41-50)

## 4 Spawning Biomass relative to SBMSY

## 5 Spawning Biomass relative to SBMSY

## 6 Spawning Biomass relative to SBMSY

## 7 Probability of not overfishing (F<FMSY)

## 8 Average Yield relative to Reference Yield (Years 1-10)

## 9 Yield relative to Reference Yield (Years 1-50)

##

## 1 Prob. AAVE < 20% (Years 1-50)

## 2 Prob. AAVY < 20% (Years 1-50)

## 3 Prob. Yield > 0.5 Ref. Yield (Years 41-50)

## 4 Prob. SB > 0.1 SBMSY (Years 1 - 50)

## 5 Prob. SB > SBMSY (Years 1 - 50)

## 6 Prob. SB > 0.5 SBMSY (Years 1 - 50)

## 7 Prob. F < FMSY (Years 1 - 50)

## 8 Prob. Yield > 0.5 Ref. Yield (Years 1-10)

## 9 Mean Relative Yield (Years 1-50)

##

##

## Performance Statistics:

## MP AAVE AAVY LTY P10 P100 P50 PNOF STY Yield

## 1 curEref 1 0.33 0.53 0.95 0.13 0.38 0.22 0.93 8.4e-01

## 2 FMSYref 1 0.33 1.00 1.00 0.30 0.89 0.50 0.87 1.0e+00

## 3 FMSYref50 1 0.33 1.00 1.00 0.87 0.99 1.00 0.70 8.6e-01

## 4 FMSYref75 1 0.33 1.00 1.00 0.72 0.97 0.89 0.83 1.0e+00

## 5 NFref 1 0.33 0.00 1.00 0.95 0.99 1.00 0.00 4.8e-15The summary function returns a data frame which can be useful for referring to the PM results elsewhere in the analysis. For example,

Results <- summary(MSE, avail('PM'), silent=TRUE) # silent=TRUE to hide print-out to console## Searching for objects of class PM in package: MSEtool## Searching for objects of class PM in package: SAMtool## Searching for objects of class PM in package: DLMtoolResults$Yield # access the PM results## [1] 8.4e-01 1.0e+00 8.6e-01 1.0e+00 4.8e-15Trade-Off Plots

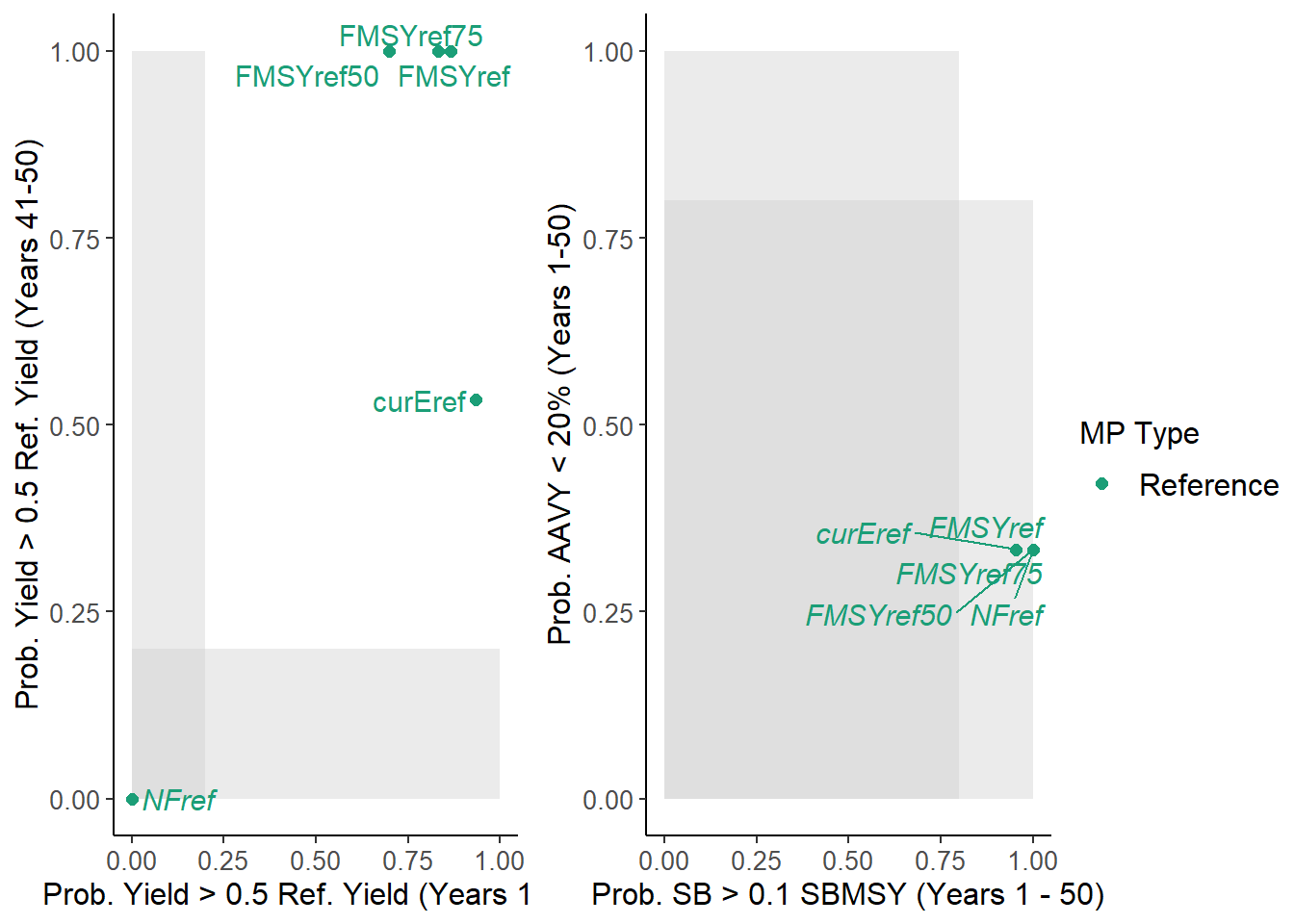

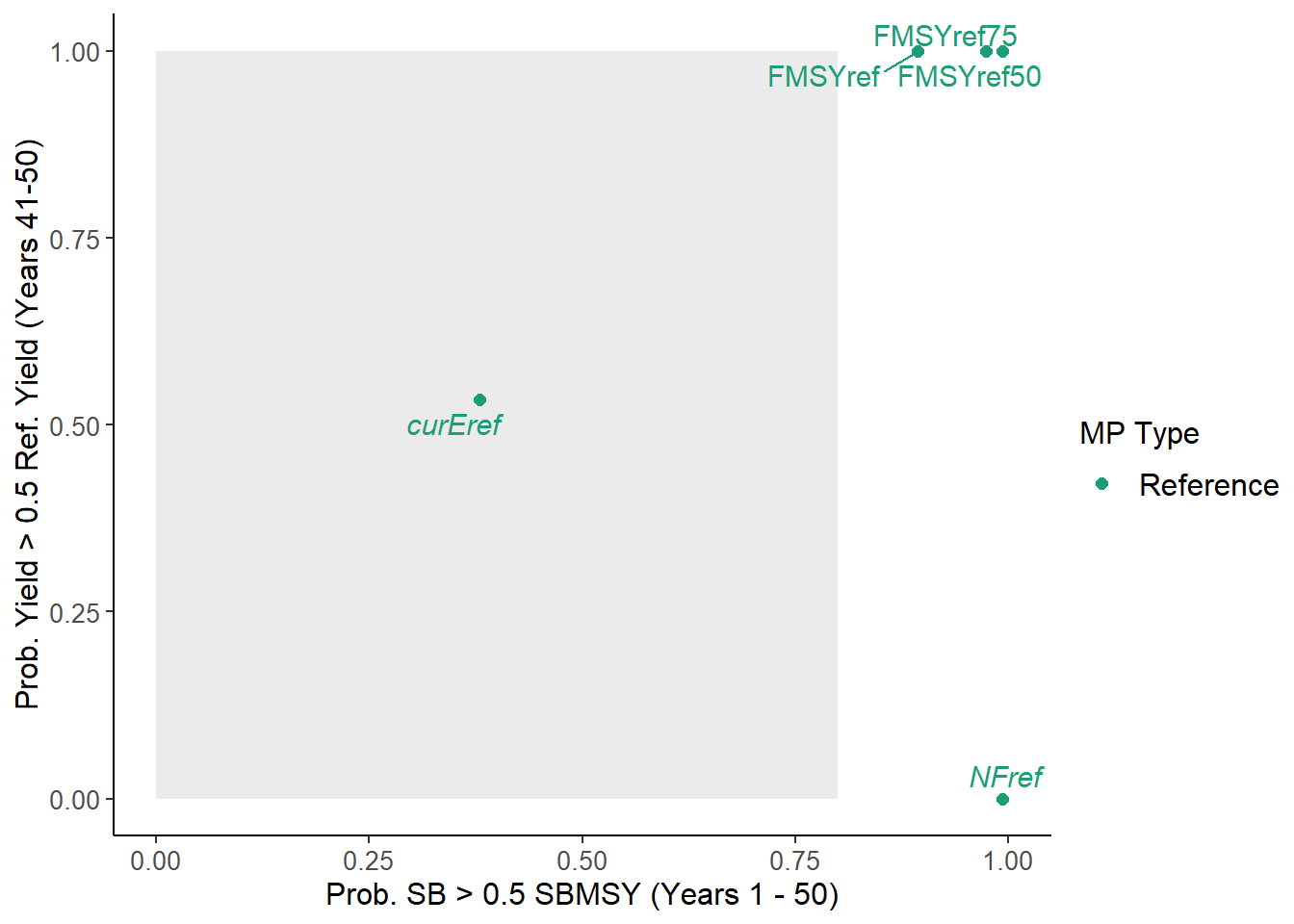

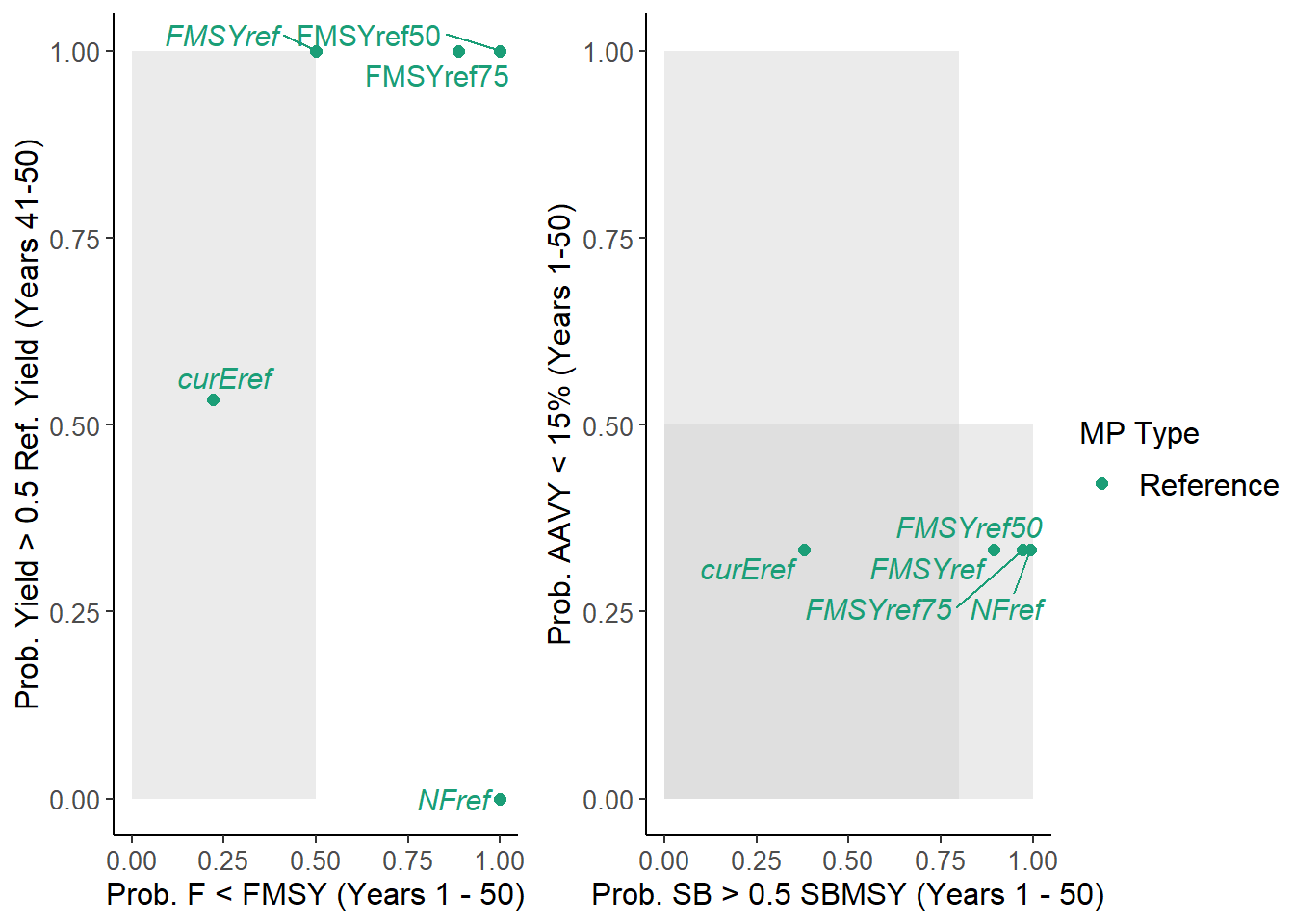

The TradePlot function takes an object of class MSE and the names of PM functions (at least 2) to produce a trade-off plot. For example:

TradePlot(MSE) # default plot

## MP STY LTY P10 AAVY Satisificed

## 1 curEref 0.93 0.53 0.95 0.33 FALSE

## 2 FMSYref 0.87 1.00 1.00 0.33 FALSE

## 3 FMSYref50 0.70 1.00 1.00 0.33 FALSE

## 4 FMSYref75 0.83 1.00 1.00 0.33 FALSE

## 5 NFref 0.00 0.00 1.00 0.33 FALSEThe order of the PM function names determines plotting on the x and y axes. For example:

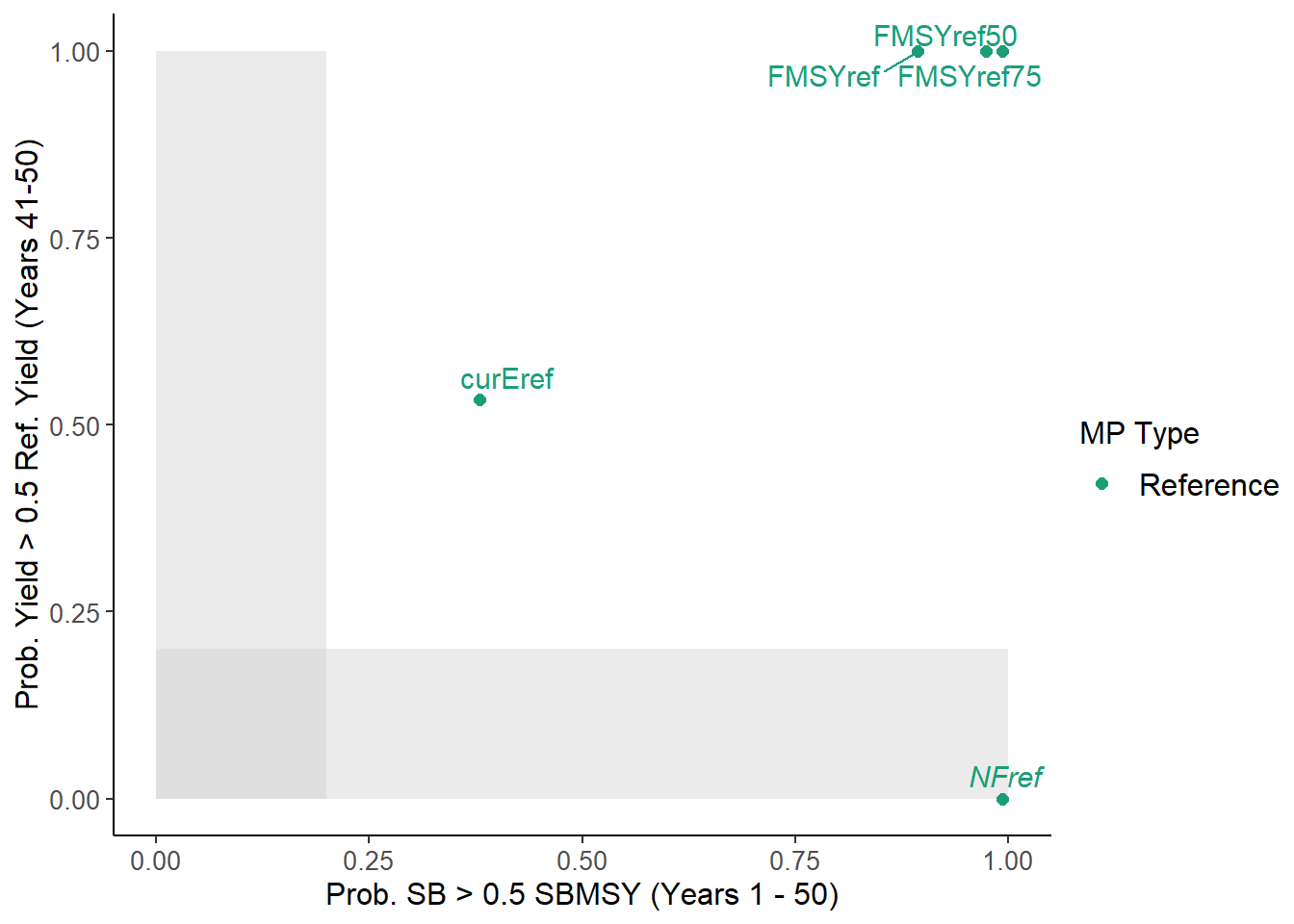

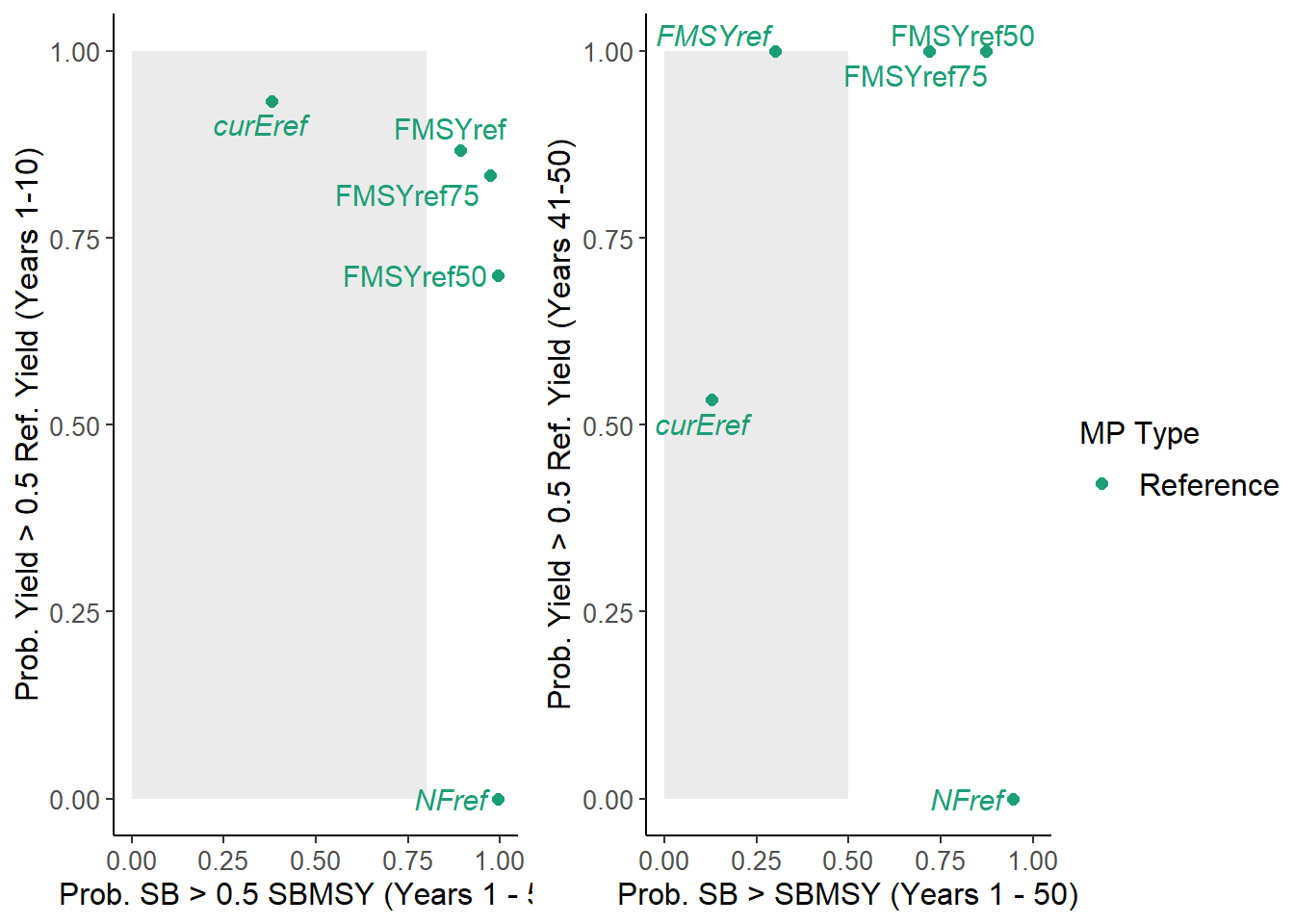

TradePlot(MSE, 'P50' ,'LTY') # x = P50, y = LTY

## MP P50 LTY Satisificed

## 1 curEref 0.38 0.53 TRUE

## 2 FMSYref 0.89 1.00 TRUE

## 3 FMSYref50 0.99 1.00 TRUE

## 4 FMSYref75 0.97 1.00 TRUE

## 5 NFref 0.99 0.00 FALSETradePlot(MSE, 'LTY' ,'P50') # x = LTY, y = P50

## MP LTY P50 Satisificed

## 1 curEref 0.53 0.38 TRUE

## 2 FMSYref 1.00 0.89 TRUE

## 3 FMSYref50 1.00 0.99 TRUE

## 4 FMSYref75 1.00 0.97 TRUE

## 5 NFref 0.00 0.99 FALSEThe PMs are recycled if an odd number are provided:

TradePlot(MSE, 'P50' ,'LTY', 'STY') ## Odd number of PMs. Recycling first PM

## MP P50 LTY STY Satisificed

## 1 curEref 0.38 0.53 0.93 TRUE

## 2 FMSYref 0.89 1.00 0.87 TRUE

## 3 FMSYref50 0.99 1.00 0.70 FALSE

## 4 FMSYref75 0.97 1.00 0.83 TRUE

## 5 NFref 0.99 0.00 0.00 FALSEThe Lims argument is used to set the vertical and horizontal acceptable risk thresholds and are interpreted in the same order as the names of the PM functions. For example:

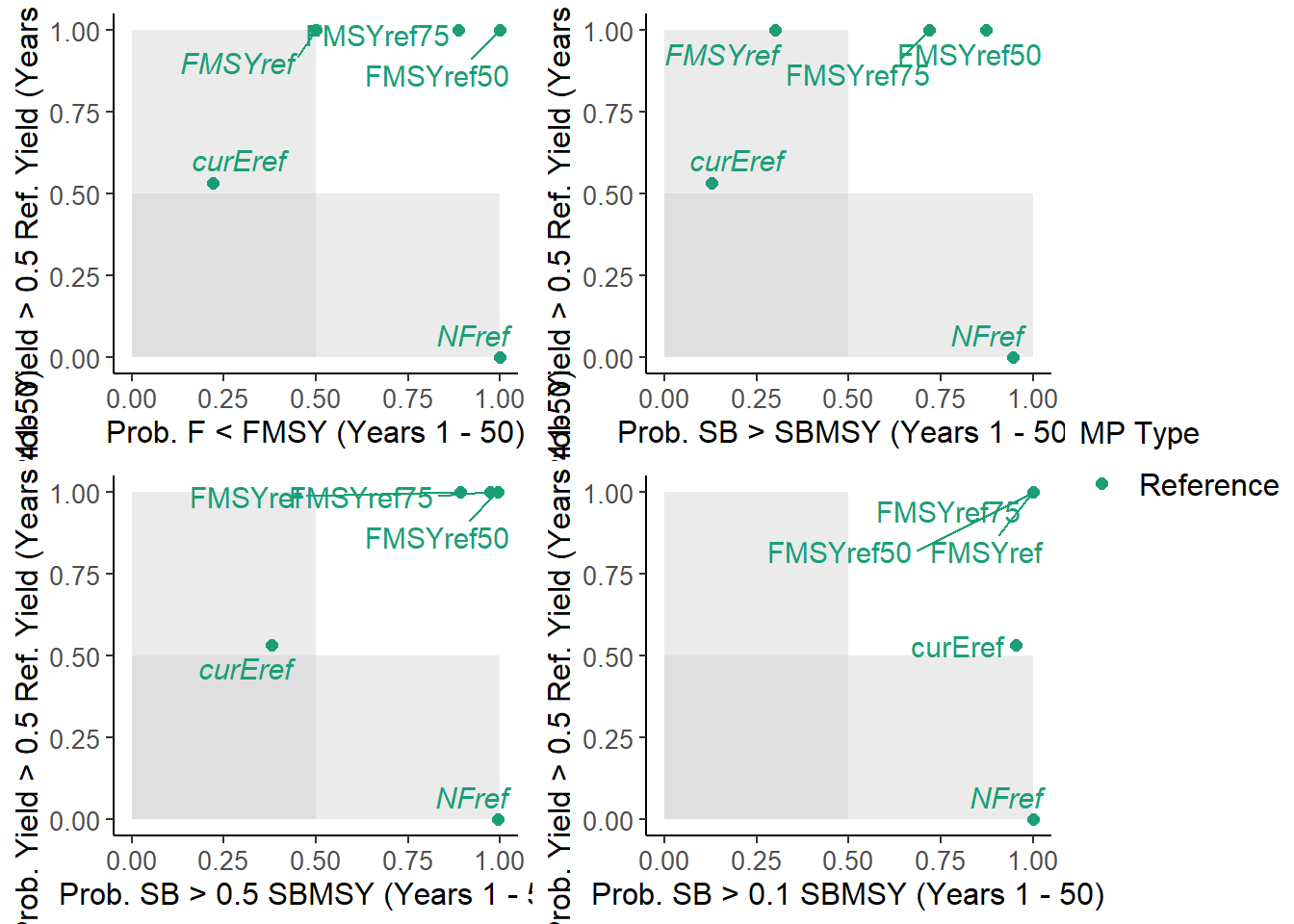

TradePlot(MSE, 'P50' ,'LTY', Lims=c(0.8, 0)) # 80% minimum acceptable risk for P50, no minimum for LTY

## MP P50 LTY Satisificed

## 1 curEref 0.38 0.53 FALSE

## 2 FMSYref 0.89 1.00 TRUE

## 3 FMSYref50 0.99 1.00 TRUE

## 4 FMSYref75 0.97 1.00 TRUE

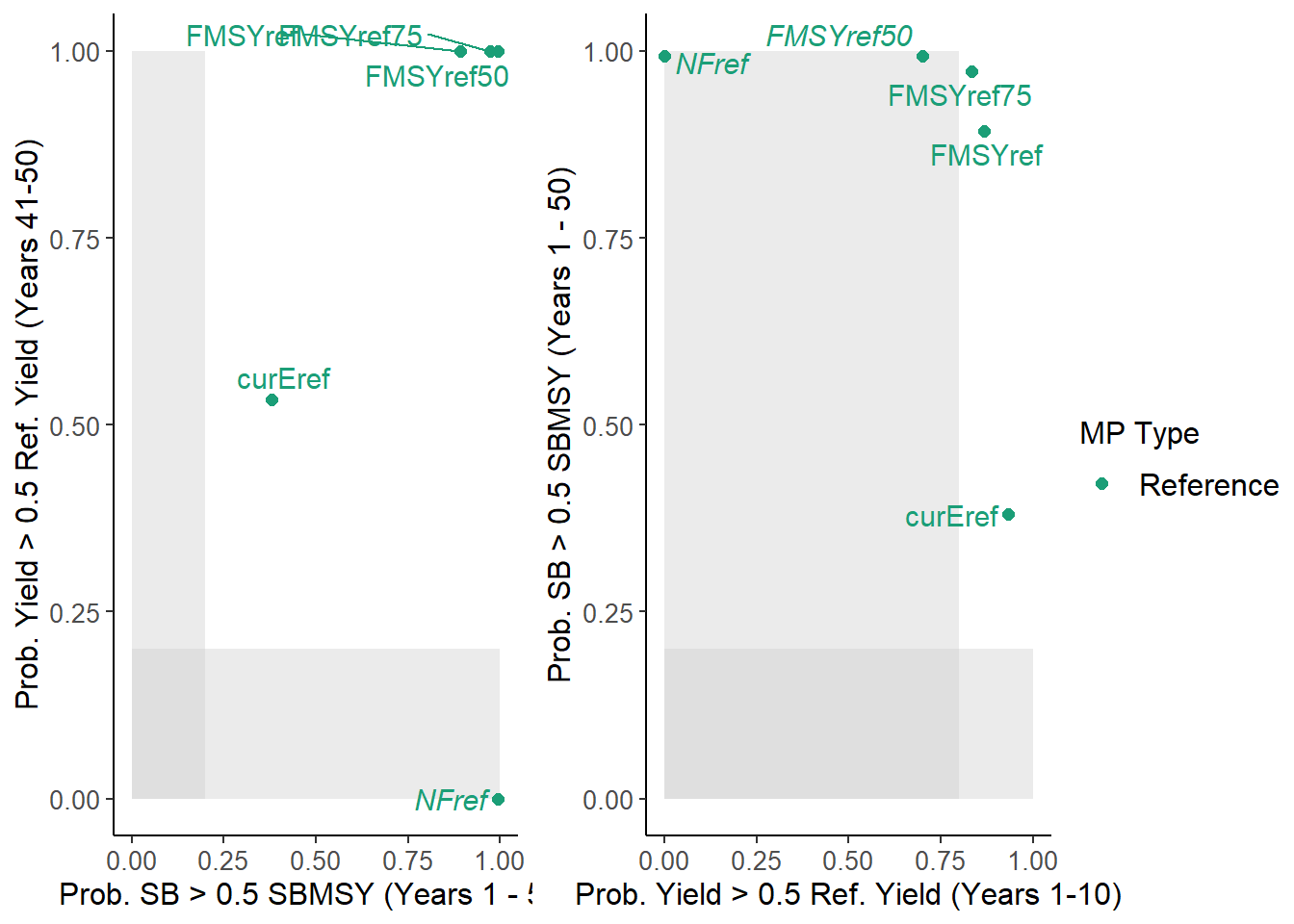

## 5 NFref 0.99 0.00 FALSETradePlot(MSE, 'P50' ,'STY', 'P100', 'LTY', Lims=c(0.8, 0, 0.5, 0)) # 80% minimum acceptable risk for P50, 50% for P100, no minimum for STY and LTY

## MP P50 STY P100 LTY Satisificed

## 1 curEref 0.38 0.93 0.13 0.53 FALSE

## 2 FMSYref 0.89 0.87 0.30 1.00 FALSE

## 3 FMSYref50 0.99 0.70 0.87 1.00 TRUE

## 4 FMSYref75 0.97 0.83 0.72 1.00 TRUE

## 5 NFref 0.99 0.00 0.95 0.00 FALSEThe TradePlot function returns a data frame with the results of the performance metrics, and a column indicating if an MP has met minimum performance criteria for all performance metrics. In the previous example, 2 MPs (FMSYref50, FMSYref75) met the minimum performance criteria for all four performance metrics.

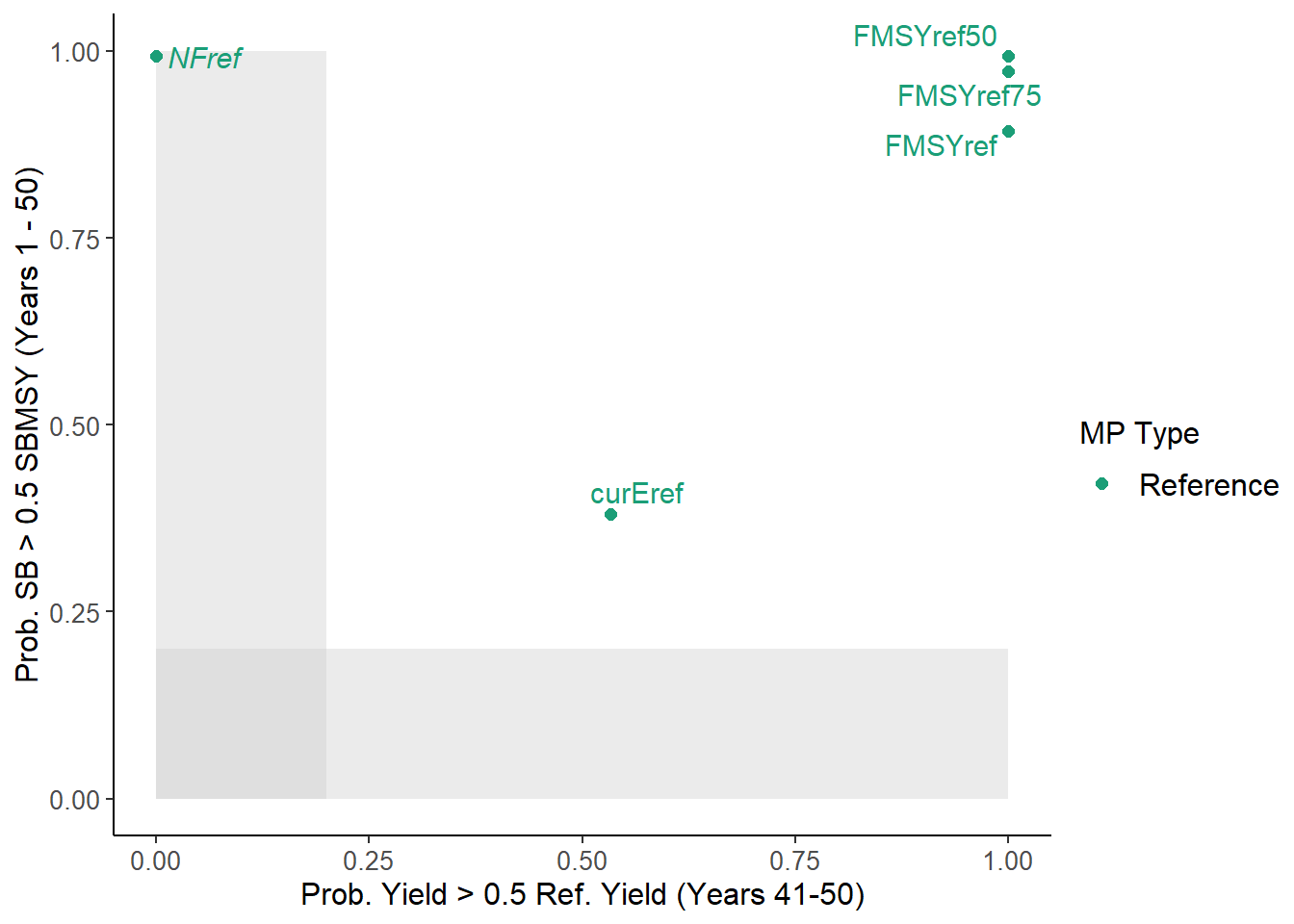

The TradePlot function can be used to make a variety of custom trade-off plots. For example, the Tplot, Tplot2, and Tplot3 functions all use this function to produce different trade-off plots:

Tplot## function(MSEobj, Lims=c(0.5, 0.5, 0.5, 0.5, 0.5, 0.5, 0.5, 0.5), ...) {

## if (class(Lims)!="numeric") stop("Second argument must be numeric")

## TradePlot(MSEobj, Lims=Lims, PMlist=list("PNOF", "LTY", "P100", "LTY", "P50", "LTY", "P10", "LTY"), ...)

## }

## <bytecode: 0x000000001f828df0>

## <environment: namespace:MSEtool>Tplot(MSE)

## MP PNOF LTY P100 P50 P10 Satisificed

## 1 curEref 0.22 0.53 0.13 0.38 0.95 FALSE

## 2 FMSYref 0.50 1.00 0.30 0.89 1.00 FALSE

## 3 FMSYref50 1.00 1.00 0.87 0.99 1.00 TRUE

## 4 FMSYref75 0.89 1.00 0.72 0.97 1.00 TRUE

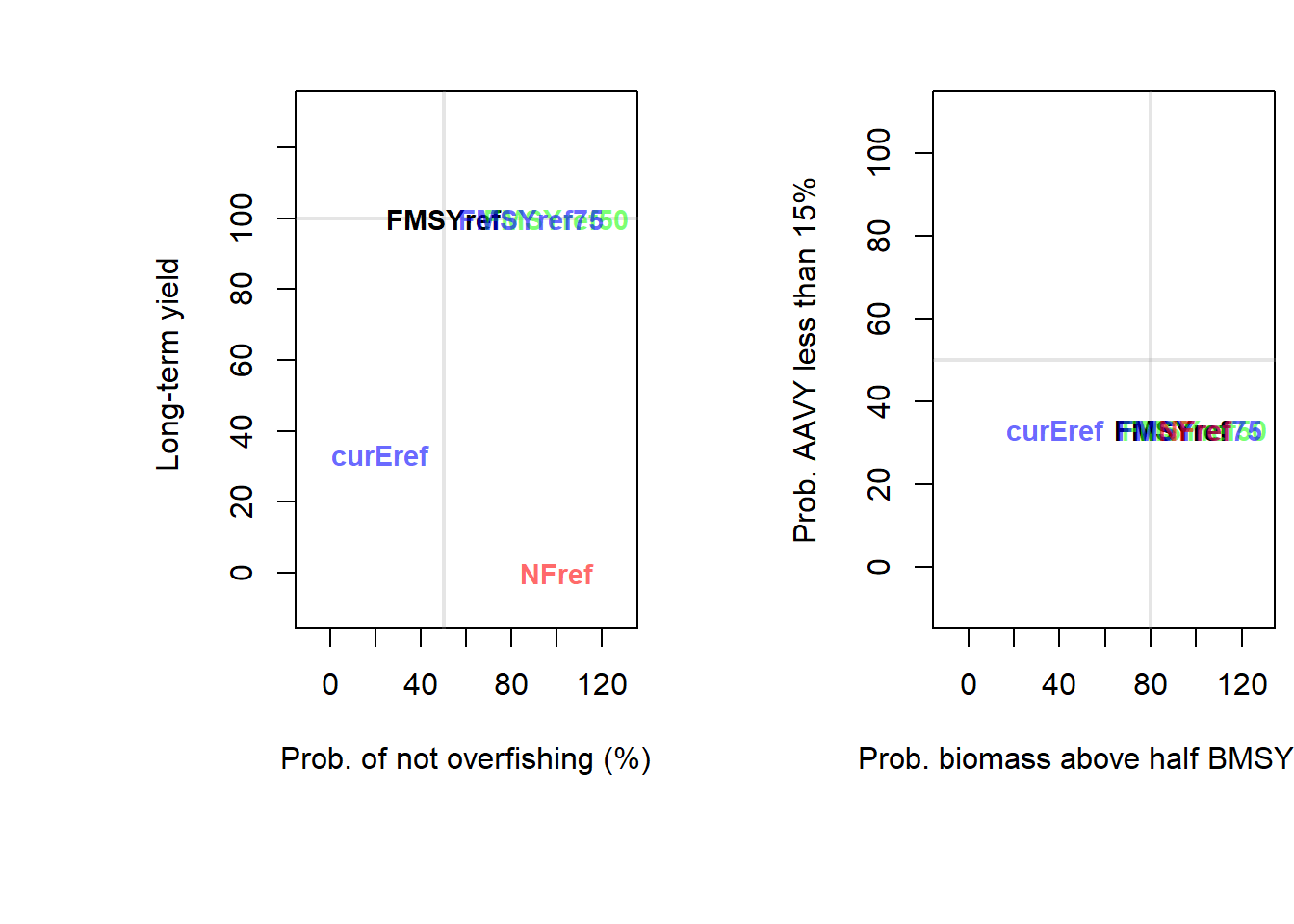

## 5 NFref 1.00 0.00 0.95 0.99 1.00 FALSESimilarly, we can easily reproduce NOAA_plot using the Tradeplot function:

NOAA_plot(MSE)## PNOF B50 LTY VY

## curEref 22.0 38.0 33.3 33.3

## FMSYref 50.0 89.3 100.0 33.3

## FMSYref50 100.0 99.3 100.0 33.3

## FMSYref75 88.7 97.3 100.0 33.3

## NFref 100.0 99.3 0.0 33.3TradePlot(MSE, Lims=c(0.5, 0, 0.8, 0.5),

PMlist=list("PNOF", "LTY", "P50", "AAVY"), Refs=list(AAVY=0.15))

## MP PNOF LTY P50 AAVY Satisificed

## 1 curEref 0.22 0.53 0.38 0.33 FALSE

## 2 FMSYref 0.50 1.00 0.89 0.33 FALSE

## 3 FMSYref50 1.00 1.00 0.99 0.33 FALSE

## 4 FMSYref75 0.89 1.00 0.97 0.33 FALSE

## 5 NFref 1.00 0.00 0.99 0.33 FALSE